The importance of education cannot be overstated. Most individuals want to go to college or university and acquire a high-paying job. Education helps in achieving one’s objectives and establishing one’s future. Higher education courses such as CA and CMA are available for those who have completed secondary school.

CA Vs. CMA

CA is a course one takes after completing their secondary education, while CMA is a course one takes after completing their undergraduate education. CA is a course that enables one to work in the financial industry and in company that is based on accounting principles. The CMA program prepares students for positions such as chairman, managing director, and a slew of other leadership positions in both the public and private sectors.

After high school, students have the option of pursuing a degree in Chartered Accountancy (CA). In order to settle the accounts, a CA course was founded in Scotland in 1854. Professional accounting bodies have been established in Scotland by accountants. A person who has taken the CA course should devote their time to studying thoroughly.

One may work in the private sector and handle duties like financial reporting, audit, taxes, forensic accounting, company recovery, accounting procedures, and more after completing the CA training course.. CA is the toughest course, requiring an individual’s full attention and willingness to succeed. This is the path of study chosen by those who have a strong sense of purpose.

The Certified Management Accountant Course (CMA) is a management course that may be taken after high school. CMA is similar to CA, however the final goals vary. Management accounting and financial accounting qualifications may be obtained via the CMA, a professional-level certification program. With a CMA credential, you can demonstrate that you’ve honed your skills in financial management and management ethics.

What does CA stand for?

After completing their secondary school, students may opt to continue their education at the college level by enrolling in CA. A person may pursue a CA degree after completing the ICAI program in their 12th grade year. There are just a few persons who want to become financial accountants who want to become Chartered Accountants (CAs).

In 1854, the first Scottish CAs opened their doors for business. People in Scotland established a professional accounting organisation, CA, to use for accounting.

In comparison to the other classes, one should devote more time and attention to this one. One of the many benefits of being a Chartered Accountant is being able to provide advice to others on the accuracy of their financial records. The five-year CA program requires a lot of focus and dedication on the part of the student.

This is the course of choice for students with a keen interest in accounting. Forensic Finance, Corporate Finance & Taxation, Forensic & Forensic Accounting and Financial Reporting may all be done after completing the CA degree. CA offers courses in financial and marketing management.

By enrolling in a CA program, a person can gain knowledge and skills such as high-level strategic abilities, the ability to contribute to society, multiple career options, the ability to assume responsibility, a clear path to the future, the ability to analyze and solve problems, and the ability to demand their own choices.

What is the CMA, precisely?

The CMA was founded by the government in 1959 and is a recognized professional school. After completing their secondary school, a student decided to pursue a career as a Certified Management Accountant (CMA). There were some parallels between CMA and CA. Those who complete the Certified Management Accountant (CMA) program may get certifications in management accounting and financial accounting.

In the United States, the Certified Management Accountant (CMA) course lasts six months and is accepted worldwide. The CMA program may be completed in three to four years in India, and the diploma is recognized across the country. The CMA course is a difficult one, and one must concentrate on their goals in order to succeed.

Compared to the CA, the Certified Management Accountant (CMA) course is a lot less difficult. To become a Certified Management Accountant (CMA), one must possess a wide range of skills, including financial management, accounting theory, accounting practice, decision-making, and ethics.

The managerial positions in the commercial and public sectors may be grasped by an individual. CMAs may work as managing directors, marketing managers, financial controllers, cost controllers, Chief Financial Officers and many other positions after completing the CMA program.

Difference Between CA and CMA

- Finance and accounting are the focus of the CA program, which is also known as Chartered Accountant (CA). Courses in accounting and finance management are included in the Certified Management Accountant (CMA) program.

- In Scotland, where CMA was founded in May of 1959, the CA program dates all the way back to 1854.

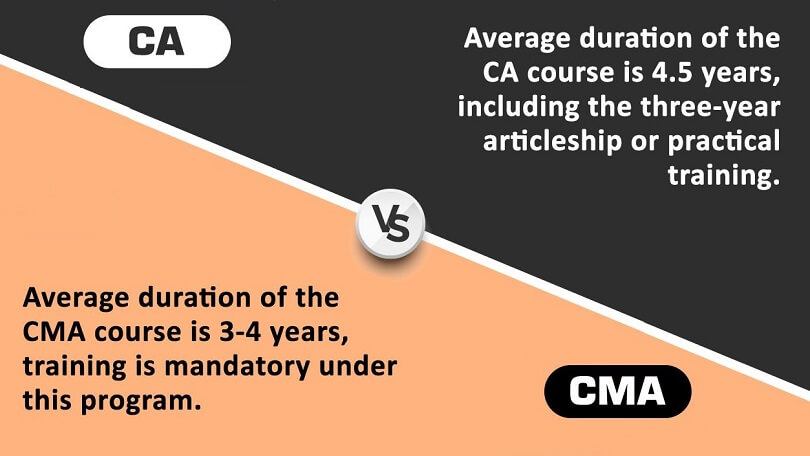

- The time it took to complete the CA degree was five years. CMA training may be completed in as little as six months in the United States or as long as three to four years in India.

- The CMA is a professional accountant’s course, although the CA is more difficult.

- CMA graduates can work as director, financial controllers, and marketing managers, but only CAs can handle corporate finance and recovery, while CMAs can manage forensic finance and corporate finance.

Conclusion

A person may pursue a CA degree after completing the ICAI program in their 12th grade year. There are just a few persons who want to become financial accountants who want to become Chartered Accountants (CAs). A career in financial management or accounting is possible after completing the CA program.

After completing their secondary school, a student decided to pursue a career as a Certified Management Accountant (CMA). Those who complete the Certified Management Accountant (CMA) program may get certifications in management accounting and financial accounting. With a CMA credential, you can demonstrate that you’ve honed your skills in financial management and management ethics.